- News

- Business News

- India Business News

- SME IPO mop-up jumps 3-fold

Trending

This story is from December 16, 2017

SME IPO mop-up jumps 3-fold

Mumbai: This has been a blockbuster year for SME initial public offers (IPOs).

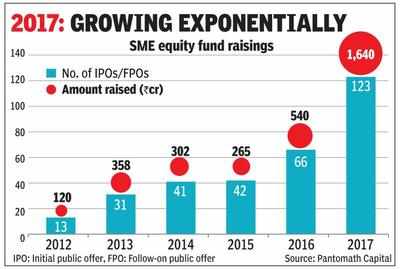

Consider this: With 123 companies mobilising about Rs 1,640 crore in 2017, it was a threefold jump in terms of amount raised compared to 2016, while the number of issuances were nearly double the previous year. The total amount raised in 2017 alone by SMEs was more than the aggregate amount raised in the previous five years, industry data showed.Although in comparative terms — about Rs 65,000 crore raised through IPOs by large companies — market players said the trend is definitely positive for SMEs tapping the stock market for funds.

The current year also witnessed two SME IPOs that were subscribed more than 100 times, with the highest being a 261-time subscription for Ice Make Refrigeration IPO that generated a book size of Rs 6,200 crore for the issue size of Rs 23.7 crore. And in early November, the IPO for ANI Integrated Solutions was subscribed 200 times.

The SME boost came on the back of strong growth potentials, attractive valuations and increasing institutional interest for shares of small & medium enterprises (SMEs). “SMEs come up with attractive valuations at early stage of their business cycle with high growth potentials and so are being noticed by large fund houses besides portfolio managers and ultra HNIs,” said Mahavir Lunawat, group MD, Pantomath Capital Advisors, a leading merchant banker to SMEs going public.

According to data on the NSE website, the HNI portion was subscribed 336 times with total demand for 31.7 crore shares, the retail part was subscribed 30.6 times and the institutional part was subscribed 15 times. According to the merchant banker, at 336 times, this was the highest ever HNI subscription figure for any SME IPO.

Earlier this week, domestic lender Yes Bank and a fund managed by global financial major HSBC invested nearly Rs 12.1 crore in the Rs 43-crore IPO for this Navi Mumbai-based company which is into business process management services. A few days prior to that, former StanC Bank Asia chief Jaspal Bindra along with his business partner Chandir Gidwani, chief of Centrum Group, had together invested Rs 50 lakh in the company to buy a 0.8% stake.

Consider this: With 123 companies mobilising about Rs 1,640 crore in 2017, it was a threefold jump in terms of amount raised compared to 2016, while the number of issuances were nearly double the previous year. The total amount raised in 2017 alone by SMEs was more than the aggregate amount raised in the previous five years, industry data showed.Although in comparative terms — about Rs 65,000 crore raised through IPOs by large companies — market players said the trend is definitely positive for SMEs tapping the stock market for funds.

The current year also witnessed two SME IPOs that were subscribed more than 100 times, with the highest being a 261-time subscription for Ice Make Refrigeration IPO that generated a book size of Rs 6,200 crore for the issue size of Rs 23.7 crore. And in early November, the IPO for ANI Integrated Solutions was subscribed 200 times.

The SME boost came on the back of strong growth potentials, attractive valuations and increasing institutional interest for shares of small & medium enterprises (SMEs). “SMEs come up with attractive valuations at early stage of their business cycle with high growth potentials and so are being noticed by large fund houses besides portfolio managers and ultra HNIs,” said Mahavir Lunawat, group MD, Pantomath Capital Advisors, a leading merchant banker to SMEs going public.

The current year also witnessed, for the first time since dedicated stock trading platforms for SME shares were launched in 2012, two anchor investors picking up stakes in an SME, One Point One Solutions, just a day before the IPO was opened. On Friday, the IPO closed with a 85 times oversubscription, with a total book size of about Rs 2,700 crore for its Rs 32-crore non-anchor part. This made it the third most subscribed SME IPO in India. Pantomath Capital was the merchant banker to One Point One Solutions, while Yoda Strategic Advisory, a new-age consultancy firm, was the adviser to the company.

According to data on the NSE website, the HNI portion was subscribed 336 times with total demand for 31.7 crore shares, the retail part was subscribed 30.6 times and the institutional part was subscribed 15 times. According to the merchant banker, at 336 times, this was the highest ever HNI subscription figure for any SME IPO.

Earlier this week, domestic lender Yes Bank and a fund managed by global financial major HSBC invested nearly Rs 12.1 crore in the Rs 43-crore IPO for this Navi Mumbai-based company which is into business process management services. A few days prior to that, former StanC Bank Asia chief Jaspal Bindra along with his business partner Chandir Gidwani, chief of Centrum Group, had together invested Rs 50 lakh in the company to buy a 0.8% stake.

End of Article

FOLLOW US ON SOCIAL MEDIA