Business News›Tech›Newsletters›Tech Top 5›Shareholder nod for Swiggy’s $1.25 billion IPO; Koo halts salaries

Daily Top 5 Daily Top 5 |

Shareholder nod for Swiggy’s $1.25 billion IPO; Koo halts salaries

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Online food delivery major Swiggy has received shareholder approval to go public. This and more in today’s ETtech Top 5.

Also in this letter:

■ Meta’s profit soars

■ Prosus elevates Ashutosh Sharma

■ Cred's offline ‘scan and pay’ payments

Sriharsha Majety, MD & group CEO, Swiggy

Sriharsha Majety, MD & group CEO, Swiggy

Shareholders have greenlit Bengaluru-based Swiggy’s initial public offering (IPO) worth $1.25 billion.

IPO details: The company plans to raise Rs 3,750 crore ($450 million) in fresh capital, in addition to an offer-for-sale (OFS) component of up to Rs 6,664 crore ($800 million), according to filings made with the Registrar of Companies.

Swiggy is looking to also pick up about Rs 750 crore from anchor investors in a pre-IPO round.

The special resolution was passed at an extraordinary general meeting (EGM) of Swiggy’s shareholders on April 23.

Major shareholders: Prosus is the largest investor in Swiggy with a 33% stake, followed by SoftBank. The company’s cofounders Sriharsha Majety, Nandan Reddy and Rahul Jaimini hold 4%, 1.6% and 1.2%, respectively, as per data platform Tracxn. Jaimini left his operational role in 2020 to join another venture, Pesto Tech.

Other shareholders include Accel, Elevation Capital, Meituan, Norwest Venture Partners, Tencent, DST Global, Qatar Investment Authority, Coatue, Alpha Wave Global, Invesco, Hillhouse Capital Group and GIC.

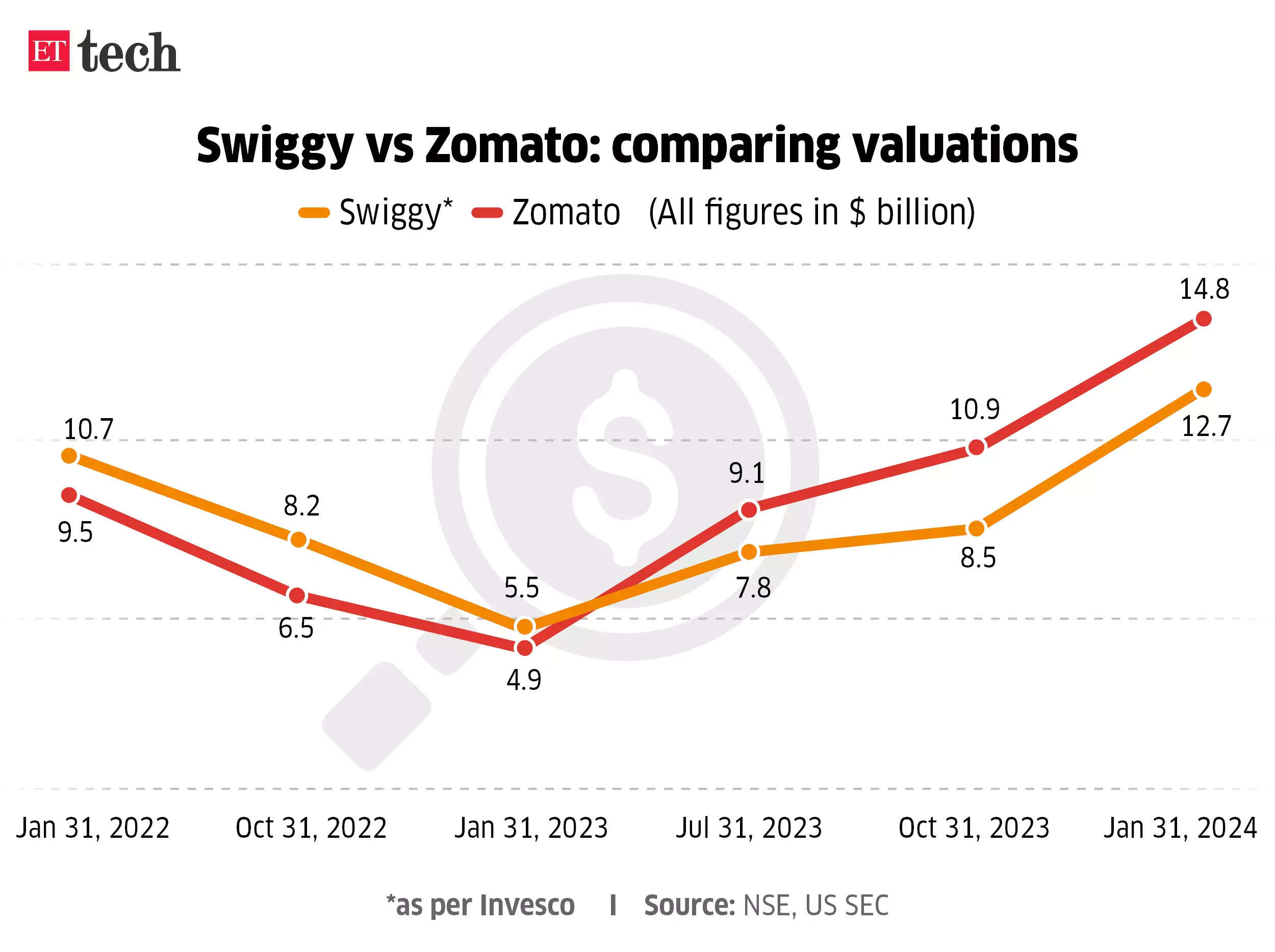

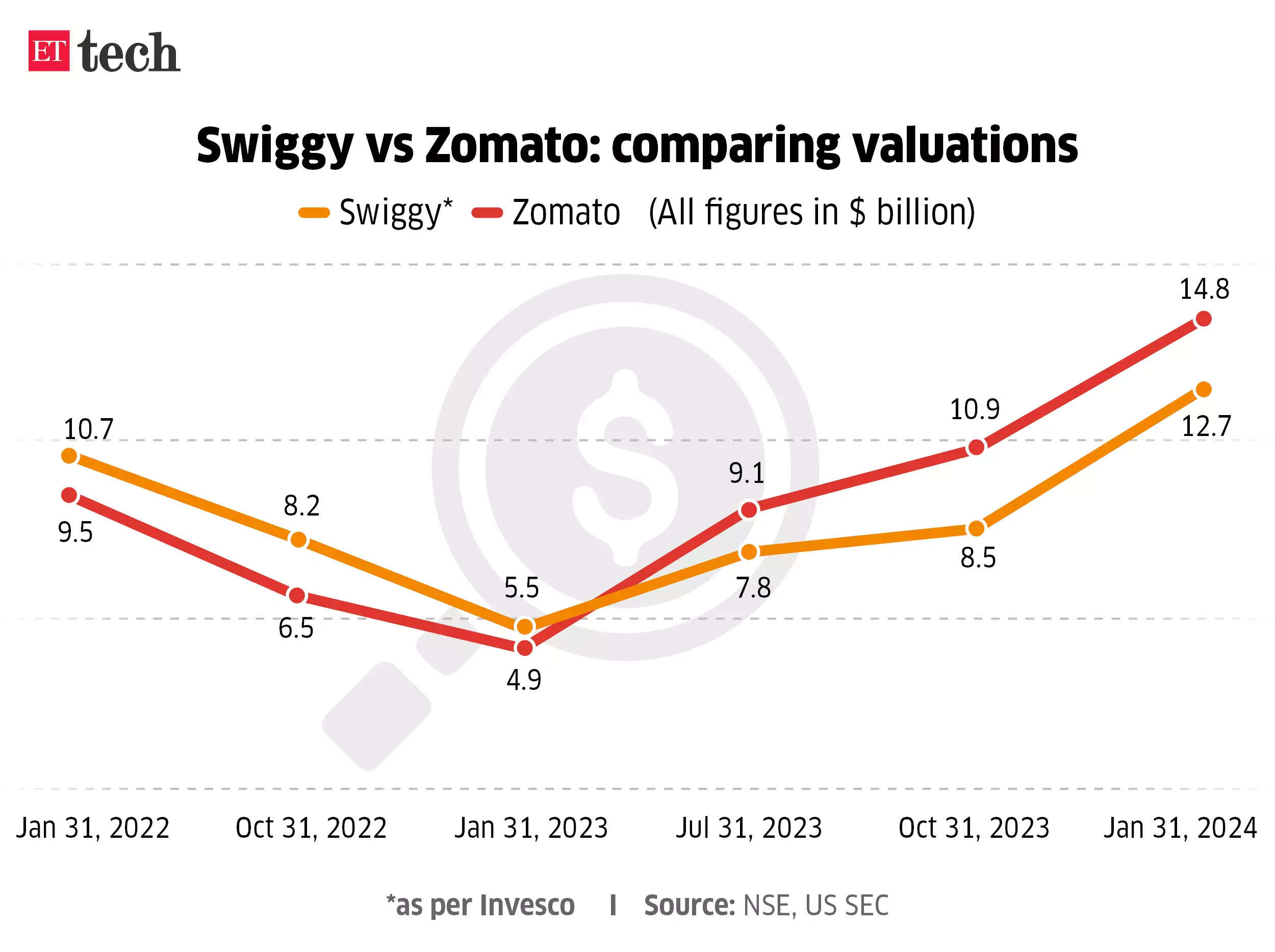

Valuation markups: Invesco, which had led Swiggy’s $700 million round in January 2022, marked up the valuation of the company to $12.7 billion.

Baron Capital had also increased the company’s fair value in its books to $12.1 billion last month.

FY23 scorecard: Swiggy reported a 45% jump in operating revenue for fiscal year ended March 2023 to Rs 8,265 crore, even as its net loss expanded 15% to Rs 4,179 crore. Total expenses in FY23 were a staggering Rs 12,884 crore, up 34% on year.

Microblogging startup Koo is halting salary payments to employees from April, amid a delay in its search for a partner to acquire the company.

Operations on: Cofounder Mayank Bidawatka said in a LinkedIn post on Thursday that the firm has done everything to extend its runway so that employees and vendors could get paid.

“Koo remains operational. It’s very well built and a fully automated product that needs little manual intervention to function. There’s a proud team that stands behind it, irrespective of where they are today,” he said.

Tell me more: Bidawatka said that the founders – TaxiForSure founder Aprameya Radhakrishna and himself – had put in a “substantial amount” from their personal funds so that salaries for March could be paid to employees.

The company had conducted salary cuts earlier. And the cofounder said future salaries will only be paid once a partnership is concluded. The development was first reported by news website Inc42.

Hunt for a partner: Koo was looking to raise funds or tie up with a strategic partner to scale operations, cofounder Mayank Bidawatka had first said in September 2023. But the talks have taken longer than expected amid a funding winter.

In February this year, Koo was in talks for a potential acquisition by VerSe Innovation, the parent firm of news aggregator Dailyhunt and short video platform Josh.

Facebook owner Meta said its quarterly profit soared last quarter to $12.4 billion from $5.71 billion during the same period last year.

Driving the profit: Propelled by a 6% increase in the average price of ads, the Mark Zuckerberg-founded company said total revenue spiked 27% to $36.5 billion, from $28.65 billion.

The company expects second-quarter 2024 total revenue to be in the range of $36.5-39 billion. Its projected expenses will be in the range of $35-40 billion, compared to its earlier guidance of $30-37 billion.

Additionally, Meta expects full-year 2024 total expenses to be in the range of $96-99 billion, from its prior outlook of $94-99 billion, due to higher infrastructure and legal costs.

Shares of the Facebook and Instagram parent dropped about 15% in extended trade, its market capitalisation plunging to about $1 trillion.

App performance: Meta reported a 7% rise in users across its apps during the quarter with an average of 3.24 billion users in March across its “family of apps” — Facebook, Instagram, Messenger and WhatsApp.

The company also said it will no longer disclose user figures specifically for Facebook.

Ad impressions delivered across Meta's family of apps also increased by 20%.

Headcount update: Meta said its workforce decreased by 10% on-year, in line with the company's move for a 'year of efficiency.' The tech giant said its global workforce now stood at 69,329, slightly more than last quarter, but down from a peak of more than 87,000 employees in 2022.

AI in focus: CEO Mark Zuckerberg told analysts that the focus on AI would “grow our investment envelope meaningfully before we make much revenue from some of these new products.”

“Building the leading AI will also be a larger undertaking than the other experiences we've added to our apps and this is likely going to take several years,” he added.

Ashutosh Sharma, head India and Southeast Asia investments, Prosus

Ashutosh Sharma, head India and Southeast Asia investments, Prosus

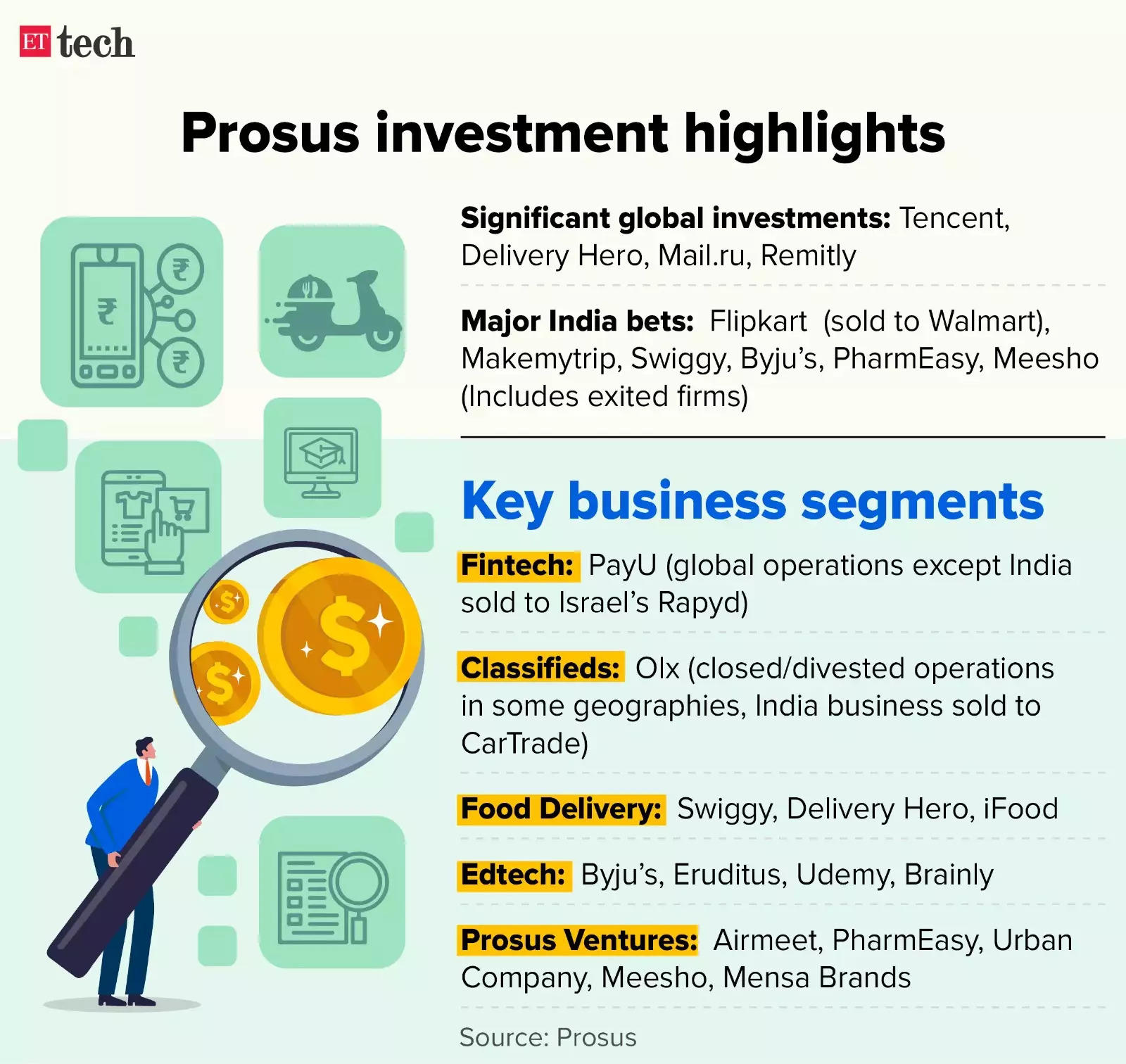

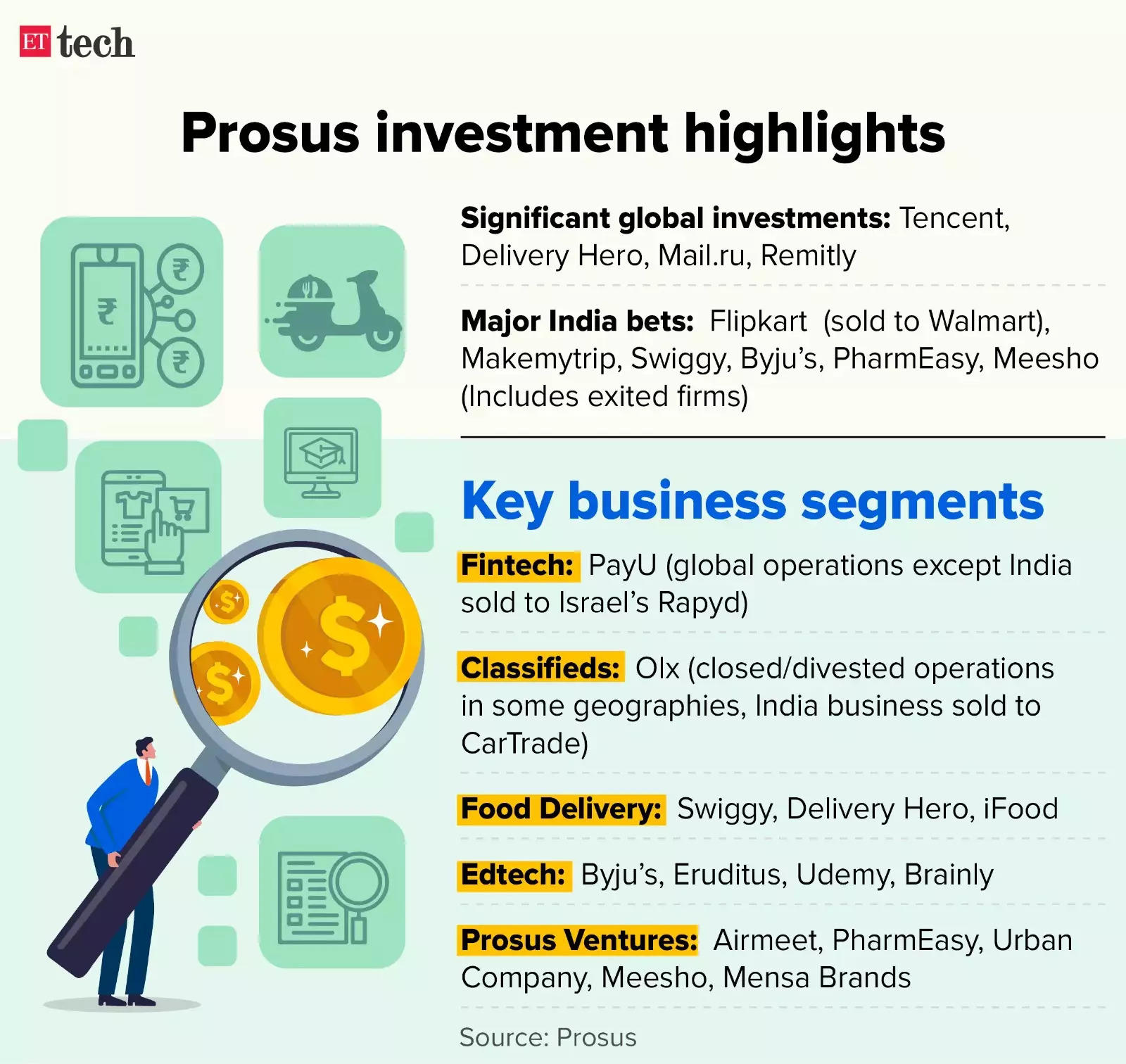

Global technology investor Prosus has elevated Ashutosh Sharma to lead its India and Southeast Asia investments.

Tell me more: Sharma, who was heading the venture arm of Prosus in India till recently, will now report to the Dutch investment firm’s interim chief executive Ervin Tu.

Sharma joined Prosus in 2016, before which he was at Norwest Venture Partners and Qualcomm Ventures.

What next? A spokesperson for Prosus said Sharma will lead early and growth-plus opportunities across India and adjacent markets.

An alumnus of IIT-BHU Varanasi, Sharma led the fund’s investment in Swiggy and Meesho. He will look at new investments for Prosus and work closely with portfolio firms like Urban Company, Mensa Brands and others.

Leadership rejig: Bob van Djik resigned as Prosus CEO in September last year after which Tu was named the interim CEO. Gautam Thakar, previously the CEO of Olx Autos, is head of edtech investments globally.

Fintech unicorn Cred has launched offline QR code-based ‘scan and pay’ payments at large format stores and will roll out the solution at select merchant outlets throughout this year.

Pilots and approval: ET wrote on April 19 that Cred was running pilots around offline payments and had received in-principle approval from the Reserve Bank of India for an online payment aggregator licence.

Target customers: The product is mostly targeted at merchants who have a large ticket size average transaction, and their customers typically pay with credit cards. The app will also offer the customer rewards against every payment transaction, irrespective of which payment instrument is being used.

Device options: Large merchants in categories such as dining and fashion can apply for this device, which is powered by Razorpay POS and Pine Labs. The terminals can be in the form of a portable device ‘pocket’ or a ‘kiosk’ meant for places with heavy footfalls, or a device which displays a dynamic QR code.

UPI momentum: The Peak XV Partners-backed startup, which has been pushing its UPI payments feature aggressively, wants its customers to start using the app to scan QR codes at premium retail outlets. These include supermarkets, quick-service restaurants, salons, fashion and other lifestyle retailers.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra and Ajay Rag in Mumbai.

Also in this letter:

■ Meta’s profit soars

■ Prosus elevates Ashutosh Sharma

■ Cred's offline ‘scan and pay’ payments

Swiggy secures shareholder nod for a potential $1.25-billion IPO

Shareholders have greenlit Bengaluru-based Swiggy’s initial public offering (IPO) worth $1.25 billion.

IPO details: The company plans to raise Rs 3,750 crore ($450 million) in fresh capital, in addition to an offer-for-sale (OFS) component of up to Rs 6,664 crore ($800 million), according to filings made with the Registrar of Companies.

Swiggy is looking to also pick up about Rs 750 crore from anchor investors in a pre-IPO round.

The special resolution was passed at an extraordinary general meeting (EGM) of Swiggy’s shareholders on April 23.

Major shareholders: Prosus is the largest investor in Swiggy with a 33% stake, followed by SoftBank. The company’s cofounders Sriharsha Majety, Nandan Reddy and Rahul Jaimini hold 4%, 1.6% and 1.2%, respectively, as per data platform Tracxn. Jaimini left his operational role in 2020 to join another venture, Pesto Tech.

Other shareholders include Accel, Elevation Capital, Meituan, Norwest Venture Partners, Tencent, DST Global, Qatar Investment Authority, Coatue, Alpha Wave Global, Invesco, Hillhouse Capital Group and GIC.

Valuation markups: Invesco, which had led Swiggy’s $700 million round in January 2022, marked up the valuation of the company to $12.7 billion.

Baron Capital had also increased the company’s fair value in its books to $12.1 billion last month.

FY23 scorecard: Swiggy reported a 45% jump in operating revenue for fiscal year ended March 2023 to Rs 8,265 crore, even as its net loss expanded 15% to Rs 4,179 crore. Total expenses in FY23 were a staggering Rs 12,884 crore, up 34% on year.

Koo halts salaries; founder says company 'will remain operational'

Microblogging startup Koo is halting salary payments to employees from April, amid a delay in its search for a partner to acquire the company.

Operations on: Cofounder Mayank Bidawatka said in a LinkedIn post on Thursday that the firm has done everything to extend its runway so that employees and vendors could get paid.

“Koo remains operational. It’s very well built and a fully automated product that needs little manual intervention to function. There’s a proud team that stands behind it, irrespective of where they are today,” he said.

Tell me more: Bidawatka said that the founders – TaxiForSure founder Aprameya Radhakrishna and himself – had put in a “substantial amount” from their personal funds so that salaries for March could be paid to employees.

The company had conducted salary cuts earlier. And the cofounder said future salaries will only be paid once a partnership is concluded. The development was first reported by news website Inc42.

Hunt for a partner: Koo was looking to raise funds or tie up with a strategic partner to scale operations, cofounder Mayank Bidawatka had first said in September 2023. But the talks have taken longer than expected amid a funding winter.

In February this year, Koo was in talks for a potential acquisition by VerSe Innovation, the parent firm of news aggregator Dailyhunt and short video platform Josh.

Meta’s profit spikes, but increased spending spooks investors

Facebook owner Meta said its quarterly profit soared last quarter to $12.4 billion from $5.71 billion during the same period last year.

Driving the profit: Propelled by a 6% increase in the average price of ads, the Mark Zuckerberg-founded company said total revenue spiked 27% to $36.5 billion, from $28.65 billion.

The company expects second-quarter 2024 total revenue to be in the range of $36.5-39 billion. Its projected expenses will be in the range of $35-40 billion, compared to its earlier guidance of $30-37 billion.

Additionally, Meta expects full-year 2024 total expenses to be in the range of $96-99 billion, from its prior outlook of $94-99 billion, due to higher infrastructure and legal costs.

Shares of the Facebook and Instagram parent dropped about 15% in extended trade, its market capitalisation plunging to about $1 trillion.

App performance: Meta reported a 7% rise in users across its apps during the quarter with an average of 3.24 billion users in March across its “family of apps” — Facebook, Instagram, Messenger and WhatsApp.

The company also said it will no longer disclose user figures specifically for Facebook.

Ad impressions delivered across Meta's family of apps also increased by 20%.

Headcount update: Meta said its workforce decreased by 10% on-year, in line with the company's move for a 'year of efficiency.' The tech giant said its global workforce now stood at 69,329, slightly more than last quarter, but down from a peak of more than 87,000 employees in 2022.

AI in focus: CEO Mark Zuckerberg told analysts that the focus on AI would “grow our investment envelope meaningfully before we make much revenue from some of these new products.”

“Building the leading AI will also be a larger undertaking than the other experiences we've added to our apps and this is likely going to take several years,” he added.

Prosus elevates Ashutosh Sharma to lead India, Southeast Asia market

Global technology investor Prosus has elevated Ashutosh Sharma to lead its India and Southeast Asia investments.

Tell me more: Sharma, who was heading the venture arm of Prosus in India till recently, will now report to the Dutch investment firm’s interim chief executive Ervin Tu.

Sharma joined Prosus in 2016, before which he was at Norwest Venture Partners and Qualcomm Ventures.

What next? A spokesperson for Prosus said Sharma will lead early and growth-plus opportunities across India and adjacent markets.

An alumnus of IIT-BHU Varanasi, Sharma led the fund’s investment in Swiggy and Meesho. He will look at new investments for Prosus and work closely with portfolio firms like Urban Company, Mensa Brands and others.

Leadership rejig: Bob van Djik resigned as Prosus CEO in September last year after which Tu was named the interim CEO. Gautam Thakar, previously the CEO of Olx Autos, is head of edtech investments globally.

Cred launches offline QR code-based ‘scan and pay’ payments

Fintech unicorn Cred has launched offline QR code-based ‘scan and pay’ payments at large format stores and will roll out the solution at select merchant outlets throughout this year.

Pilots and approval: ET wrote on April 19 that Cred was running pilots around offline payments and had received in-principle approval from the Reserve Bank of India for an online payment aggregator licence.

Target customers: The product is mostly targeted at merchants who have a large ticket size average transaction, and their customers typically pay with credit cards. The app will also offer the customer rewards against every payment transaction, irrespective of which payment instrument is being used.

Device options: Large merchants in categories such as dining and fashion can apply for this device, which is powered by Razorpay POS and Pine Labs. The terminals can be in the form of a portable device ‘pocket’ or a ‘kiosk’ meant for places with heavy footfalls, or a device which displays a dynamic QR code.

UPI momentum: The Peak XV Partners-backed startup, which has been pushing its UPI payments feature aggressively, wants its customers to start using the app to scan QR codes at premium retail outlets. These include supermarkets, quick-service restaurants, salons, fashion and other lifestyle retailers.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra and Ajay Rag in Mumbai.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.