El Paso County Residents Witness Home Value Escalations From 2024 Reassessments

O'Connor concluded that residents of El Paso County observed increases in home values due to the reassessments conducted in 2024.

EL PASO , TEXAS , UNITED STATES , May 21, 2024 /EINPresswire.com/ -- High-end El Paso County Homes Experience Greater Increases in Assessed Values than Lower-valued Properties

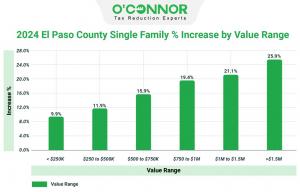

From $47 billion to $53 billion, property tax estimates surged by over 11.4%, marking a staggering increase of more than $6 billion compared to 2023. Notably, homes valued above $1.5 million in El Paso County experienced a substantial market value rise of over $42 million, soaring more than 25%. These trends suggest that higher-end homes saw the most significant price hikes in 2024. Conversely, properties valued under $250,000 witnessed the least growth, with a 9.9% increase. During the 2024 review, homes with lower values experienced a slightly less severe rise in their market worth.

In 2024, El Paso County’s real estate market had substantial growth irrespective of the size of the property. In terms of market value rise, bigger properties stood out. The value of properties with more than 8,000 square feet went up from $165 million to $176 million, the most significant increase of any size category, with a spike of 23.4%. The housing range that rose the least across all size groups was for those under 2,000 square feet, with a relatively mild by comparison increase of 10.6%.

Higher Property Value Trends Are Observed In El Paso County

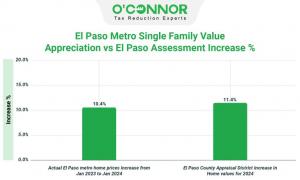

In the aftermath of the 2024 property tax reassessment in El Paso County, reports from the El Paso Central Appraisal District indicate a notable 11.4% surge in home values. Meanwhile, contrasting figures emerge from the El Paso Metro area, where the Greater El Paso Association of Realtors reports the uptick of sales by 10.4% from January 2023 to January 2024.

Properties Constructed In El Paso County Prior To 1960 Increased the Most

The year 2024 witnessed a comprehensive reevaluation of residential property values in El Paso County, which unveiled noteworthy fluctuations in property values. Significantly, real estate built prior to 1960 experienced a substantial 18% surge, constituting the most substantial increase. On the other hand, the period spanning 1981 to 2000 witnessed the smallest increase in value, with an 8.8% surge. The results of this study offer valuable insights into the various trends that are influencing the real estate market in the county. Across all construction years, there was an average growth rate of 11.4%.

The El Paso Central Appraisal District estimated the value of 3,653 residential accounts (or 43% of the total) in 2024 with an accuracy or minor overestimation, whereas 4,819 accounts (or 57%) were overvalued. This study investigates the precision of property assessments through a comparison of the 2023 sales prices and 2024 property tax reassessment values of residential properties.

Overview of El Paso County’s 2024 Property Tax Revaluation by the El Paso Central Appraisal District

The residential property values in El Paso County are experiencing significant increases, which exceed the growth rates documented in the El Paso metropolitan area. Despite the fact that residential real estate has generated substantial profits, the industry has experienced a range of conditions, with some regions experiencing growth and others experiencing declines. A considerable proportion of homeowners claim a decline in the open market price of their residential properties in recent times, a circumstance that can be attributed in part to the interest rate increase from 1.71% in January 2022 to 4.05% in January 2024. Consistent revenue patterns and ongoing increases in casualty insurance and other operational expenses also have an effect on this position.

Challenge The Assessed Value of Your Property Annually.

Property owners in Texas, particularly those residing in El Paso County, have legal entitlement and are actively encouraged to contest the evaluated worth of their property. Owners, whether residential or commercial, have the opportunity to submit information throughout the appeal process in order to contest an assessment that is deemed excessive. Owners should strongly consider submitting an appeal or seeking assistance from a property tax consulting service, since a significant number of protests lead to positive results. With more than fifty years of expertise, O’Connor is very skilled in advocating for the rights of property owners. In addition, O’Connor is dedicated to assisting property owners by efficiently decreasing taxes at a reasonable cost, employing their ample resources for this objective.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.