Investment Management Software Market is Expected to Expand at a CAGR of 11.8%: Demand, Scope, Size, and Growth by 2032

Investment Management Software Market Growth

Investment Management Software Market Research Report By, Deployment Model, Asset Class, Investment Style, End-User, Functionality, Regional

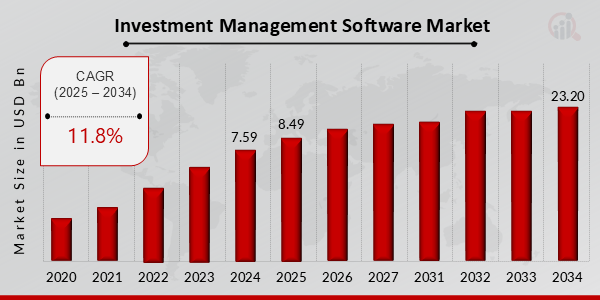

SD, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Investment Management Software Market is poised for substantial growth over the coming decade. In 2024, the market size was estimated at USD 7.59 billion and is expected to grow from USD 8.49 billion in 2025 to an impressive USD 23.20 billion by 2034. This growth reflects a compound annual growth rate (CAGR) of approximately 11.8% during the forecast period (2025–2034). Factors such as the increasing adoption of digital solutions in investment management, rising demand for automated financial processes, and growing investments in data analytics are driving the market’s growth.

Key Drivers of Market Growth

Rising Adoption of Digital Solutions in Investment Management With the rapid digitalization of financial services, investment management software has become essential for firms to enhance their operational efficiency, optimize investment strategies, and ensure seamless portfolio management. Financial institutions, asset managers, and investment advisors are increasingly integrating sophisticated software solutions to streamline their workflows and improve decision-making.

Growing Demand for Automation and Artificial Intelligence (AI) The demand for automated processes in the investment management industry is rising. Investment management software with integrated AI and machine learning capabilities allows firms to analyze large datasets, predict market trends, and make more informed investment decisions. This shift towards automation is helping firms reduce costs and improve returns, further driving the market for these software solutions.

Complexity of Investment Portfolios As investors diversify their portfolios across a wider range of assets, including alternative investments, the complexity of portfolio management increases. Investment management software helps firms to manage this complexity, track performance in real-time, and adjust strategies accordingly. This has led to an increasing demand for advanced software tools capable of handling various asset classes.

Growing Importance of Regulatory Compliance With the growing complexity of regulations in the financial sector, investment management software solutions are being adopted to ensure compliance with local and international laws. These platforms help firms adhere to regulatory requirements while maintaining transparency, reducing risks, and minimizing operational disruptions.

Expanding Financial Markets in Emerging Economies As financial markets in emerging economies continue to expand, the demand for investment management software is expected to grow. These markets are embracing technology to improve investment management practices, offering significant growth opportunities for software providers.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/22935

Key Companies in the Investment Management Software Market

• State Street Global Advisors

• Invesco

• Franklin Templeton

• Vanguard

• Fidelity Investments

• Kemper Corporation

• MFS Investment Management

• T. Rowe Price

• UBS Asset Management

• Nuveen

• BlackRock

• Morgan Stanley Investment Management

• Northern Trust

• JPMorgan Chase Co.

• Goldman Sachs Asset Management

Browse In – Depth Market Research Report : https://www.marketresearchfuture.com/reports/investment-management-software-market-22935

Market Segmentation

To provide a detailed analysis, the investment management software market is segmented based on deployment type, application, end-user, and region.

By Deployment Type

Cloud-Based Solutions: These solutions offer scalability, remote access, and lower upfront costs, contributing to their growing popularity.

On-Premise Solutions: These are deployed within the organization’s infrastructure, offering greater control over data security and compliance.

By Application

Portfolio Management: Software solutions designed to help firms manage and optimize their investment portfolios, balancing risk and returns.

Risk Management: Tools used to assess and mitigate financial risks, such as market volatility and liquidity issues.

Trading & Compliance: Platforms that enable investment firms to execute trades, track regulatory changes, and ensure compliance.

Client Reporting & Analytics: Software used for generating customized reports and providing actionable insights into investment performance.

By End-User

Asset Management Firms: These firms use investment management software to manage large portfolios, make data-driven decisions, and comply with regulations.

Hedge Funds: Hedge funds adopt advanced software solutions to track and manage complex investment strategies and mitigate risks.

Private Equity Firms: These firms utilize investment software for portfolio management and performance analytics.

Banks and Financial Institutions: Banks leverage software to streamline their investment processes, improve client offerings, and reduce operational risks.

By Region

North America: Leading the market, driven by the presence of major financial institutions, increasing adoption of digital solutions, and a mature financial ecosystem.

Europe: Significant growth due to increasing regulatory compliance requirements and a strong demand for portfolio management tools.

Asia-Pacific: The fastest-growing region, propelled by expanding financial markets, rising digital adoption, and growing investment activity.

Rest of the World (RoW): Moderate growth expected in regions such as Latin America, the Middle East, and Africa, as investment firms increasingly turn to technology for efficiency gains.

Procure Complete Research Report Now : https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22935

The investment management software market is expected to experience robust growth, driven by the increasing demand for digital solutions, automation, and AI in financial services. With a projected CAGR of 11.8% from 2025 to 2034, the market is set to reach USD 23.20 billion by the end of the forecast period. The growing complexity of investment portfolios, the need for regulatory compliance, and the expansion of financial markets in emerging economies will further fuel market growth. As financial institutions continue to embrace technological advancements, investment management software will play an essential role in optimizing investment strategies and improving operational efficiency across the sector.

Related Report –

Handheld Spectrum Analyzer Market

Handwriting Digital Pen Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release