Crypto index platform J’JO releases Market Segment Indexes’ to enable users to build personalized investment portfolios

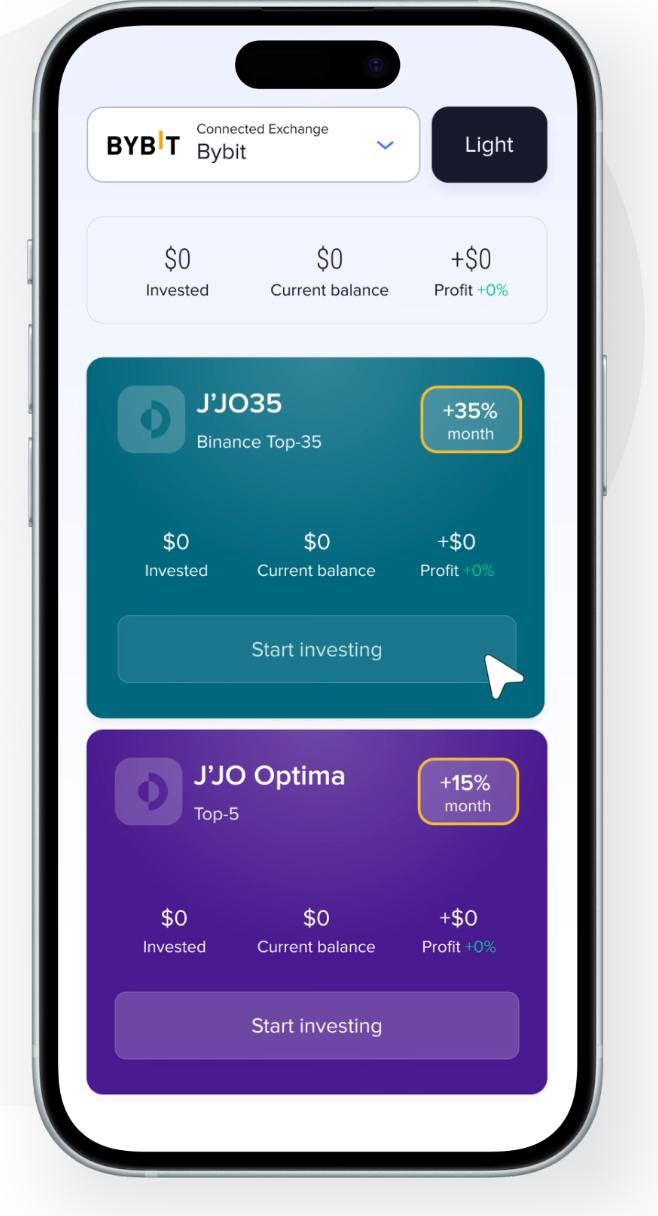

J’JO35, the project’s premier solution, is an index of the top 35 cryptocurrencies by market capitalization. This index provides users with a simplified way to invest in digital assets through a strategy focused on minimizing risk.

/EIN News/ -- SINGAPORE, Feb. 02, 2025 (GLOBE NEWSWIRE) -- J’JO Finance, a user-centric solution for risk-minimized crypto investing, launches “Market Segment Indexes,” its’ latest feature enabling users to customize their digital asset indexes. This solution offers users, particularly retail investors, a flexible tool to build their own crypto-investing strategy by hand-picking the specific tokens for their portfolio and determining specific allocations per currency.

For new users and retail investors, investing in digital assets can be overwhelming for several reasons. As a nascent industry known for its drastic price swings, crypto investing usually requires a solid understanding of technical jargon and the know-how to navigate a complex landscape of digital wallets and exchange platforms. This learning curve also presents challenges in finding reliable information needed for informed investment decisions. Furthermore, the ever-changing market conditions require investing a lot of time while constantly learning about new technologies with a vast ecosystem, meaning that no matter how much time spent, most users won’t ever fully understand what they are investing in.

J’JO’s core product is the J’JO35 index which provides users with a stable and diversified portfolio of the top 35 cryptocurrencies based on market capitalization, automatically rebalancing each month. New users only need an existing exchange account with one of the supported centralized exchanges to invest in the index. Included among these exchanges are Kraken, Binance, KuCoin, ByBit, Gate.io, and OKX. Users can choose any cryptocurrencies from any of the more than 11 supported centralized exchanges, allocating their funds however they see fit. J’JO automatically manages user funds via an API but never controls custody of the funds, nor will it transfer or withdraw them from an exchange.

By introducing the Market Segment Indexes feature, J’JO aims to expand its user-oriented ecosystem by offering savvy investors greater control over their investing strategy. This feature allows users to not only build customized indexes based on preference but also create an index from a preset based on the market segment, such as DeFi, AI, real-world assets, etc. Market Segment Indexes also enables experienced investors who recognize the potential of a specific segment to leverage J’JO’s dynamism and adaptability to try to maximize their profits. Of course, this approach can provide greater profit potential, but at a higher risk.

J’JO is free for investments of up to $500 as part of its mission to help onboard new users and get them acquainted with the service and empower them to invest confidently and in an informed manner. JJO’s Light plan costs $140 a year, offering unlimited investing amounts while allowing a single user to connect to up to three supported exchanges. Its Pro plan, priced at $188 a year, enables unlimited connections to supported exchanges while granting users access to the new Market Segment Indexes feature. Pro plan users also receive advanced analytics tools to track and compare returns.

“At J’JO we aim to provide a sustainable and secure mechanism for crypto users with the intent of being the primary tool for investing and managing their peer-to-peer finances,” says Andrei Ponomarev, Co-Founder of J’JO. “Market Segment Indexes allows experienced investors to fine-tune their strategies and maximize profits through their market knowledge and valuations. While this new feature enables investors to take more initiative, our top-35 index remains our core offering, providing new users and non-crypto natives with a diversified and user-friendly investing solution. By spreading their investments across the top 35 projects, users avoid putting all their eggs in one basket and don’t have to study blockchain theory or analyze hundreds of projects and market trends to make smart decisions.”

About J’JO:

Founded in 2020 and based in Singapore, J’JO offers the J’JO35, an index of the top 35 cryptocurrencies in the market. The service connects users to their exchange of choice and balances their portfolios according to the index. As the S&P 500 of the decentralized economy, J’JO is a service for investing in a market index of cryptocurrencies that allows users to maintain full control over their assets. Since 2020, J’JO35 has outperformed Bitcoin and Ethereum and has an APY of 67 percent. For more information, visit: https://jjo.finance/en

Contact:

Ofir Sever

ofir@reblonde.com

Disclaimer: This content is provided by jjo.finance. The statements, views and opinions expressed in this column are solely those of the content provider. The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Please conduct your own research and invest at your own risk.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0119e342-3d83-4128-92c4-7834ea6428f2

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release