Motorcycle Insurance Market is Likely to Expand USD 95.48 Billion at 4% CAGR by 2032

Motorcycle Insurance Market Growth

Motorcycle Insurance Market Research Report Information By, Type, Application, and Region

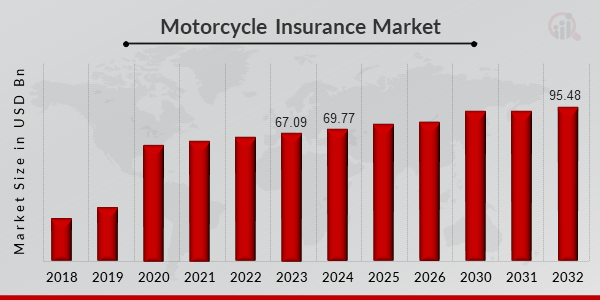

MD, UNITED STATES, February 14, 2025 /EINPresswire.com/ -- The global Motorcycle Insurance market has experienced steady growth in recent years and is projected to expand further in the coming decade. In 2023, the market size was valued at USD 67.09 billion and is expected to grow from USD 69.77 billion in 2024 to USD 95.48 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4% during the forecast period (2024–2032). The market's growth is primarily driven by the increasing number of motorcycle owners, rising demand for cost-effective insurance solutions, and advancements in digital insurance platforms.

Key Drivers of Market Growth

Increasing Number of Motorcycle Owners

The rising popularity of motorcycles as an affordable and fuel-efficient mode of transportation is a significant driver of market growth. Additionally, increased urbanization and the growing preference for two-wheelers in densely populated cities have led to a surge in motorcycle ownership, thereby boosting the demand for insurance coverage.

Demand for Cost-Effective and Convenient Insurance Solutions

Consumers are seeking insurance plans that offer comprehensive coverage at affordable premiums. Insurers are responding by introducing flexible policies, pay-as-you-ride insurance options, and bundled packages that provide financial protection without excessive costs.

Advancements in Digital Insurance Platforms

The adoption of digital insurance platforms and InsurTech solutions has streamlined the motorcycle insurance process. Online policy issuance, AI-driven risk assessment, and mobile-based claims processing have enhanced customer convenience, driving market growth.

Government Regulations and Mandatory Insurance Policies

Many countries have implemented strict regulations requiring motorcycle owners to have at least basic liability insurance. These mandates have contributed to a steady increase in policy purchases, ensuring the market’s continued expansion.

Growing Popularity of Electric Motorcycles

The rise of electric motorcycles (e-bikes) has led to new insurance policy offerings. As governments promote eco-friendly transportation, insurance providers are developing specialized coverage plans for electric two-wheelers, further fueling market growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/10016

Key Companies in the Motorcycle Insurance Market Include

• Allianz SE

• GEICO

• AXA SA

• Progressive Corporation

• State Farm Mutual Automobile Insurance Company

• Allstate Insurance Company

• Liberty Mutual Insurance

• Aviva plc

• Tokio Marine Holdings, Inc.

• Nationwide Mutual Insurance Company

• American International Group (AIG)

• Berkshire Hathaway Inc.

• Zurich Insurance Group

• Farmers Insurance Group

• Chubb Limited, among others.

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/motorcycle-insurance-market-10016

Market Segmentation

To provide a comprehensive analysis, the Motorcycle Insurance market is segmented based on coverage type, policy type, end-user, and region.

1. By Coverage Type

• Liability Insurance: Covers damages caused to third parties, including bodily injury and property damage.

• Comprehensive Insurance: Provides full protection, including theft, vandalism, and weather-related damages.

• Collision Insurance: Covers repair costs for the insured motorcycle in case of an accident.

• Personal Injury Protection (PIP): Covers medical expenses for the rider and passengers.

• Uninsured/Underinsured Motorist Coverage: Protects against accidents involving drivers without adequate insurance.

2. By Policy Type

• Annual Insurance Policies: Standard coverage plans with fixed-term premiums.

• Pay-As-You-Ride (Usage-Based Insurance): Dynamic pricing based on riding habits and mileage.

• Short-Term Policies: Temporary insurance for rental or occasional motorcycle use.

3. By End-User

• Individual Riders: Personal motorcycle owners seeking protection against theft, damage, and liability.

• Commercial Users: Businesses utilizing motorcycles for delivery, ride-sharing, or rental services.

4. By Region

• North America: A leading market due to high motorcycle adoption rates and stringent insurance regulations.

• Europe: Growth driven by increased leisure motorcycling and government safety initiatives.

• Asia-Pacific: Fastest-growing region, fueled by the rising number of motorcycle owners in countries like India, China, and Indonesia.

• Rest of the World (RoW): Includes Latin America, the Middle East, and Africa, with increasing demand for insurance due to expanding urban mobility.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=10016

The global Motorcycle Insurance market is poised for continued growth, driven by rising motorcycle ownership, evolving consumer demands, and digital transformation in the insurance sector. As insurers introduce innovative coverage options and regulatory frameworks tighten, the market is expected to remain resilient, providing enhanced financial security to motorcycle owners worldwide.

Related Report –

Banking Market

https://www.marketresearchfuture.com/reports/banking-market-23852

Investor Esg Software Market

https://www.marketresearchfuture.com/reports/investor-esg-software-market-23872

Credit Card Payment Market

https://www.marketresearchfuture.com/reports/credit-card-payment-market-23915

Car Insurance Aggregators Market

https://www.marketresearchfuture.com/reports/car-insurance-aggregators-market-23929

Home Loan Market

https://www.marketresearchfuture.com/reports/home-loan-market-24178

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release