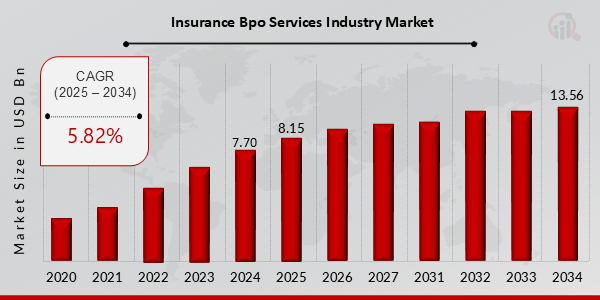

Insurance BPO Services Industry Market Size Forecasted to Grow at 5.82% CAGR, Reaching USD 13.56 Billion by 2034

Insurance BPO Services Industry Market Trends

Insurance BPO Services Industry Market Research Report By, Service Type, Insurance Line, Technology, Client Size, Delivery Model, Regional

CT, UNITED STATES, March 18, 2025 /EINPresswire.com/ -- The global Insurance BPO Services Industry market has been experiencing steady growth and is poised for further expansion in the coming years. In 2024, the market size was valued at USD 7.70 billion and is projected to grow from USD 8.15 billion in 2025 to an impressive USD 13.56 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.82% during the forecast period (2025–2034). This growth is primarily driven by increasing demand for cost-efficient outsourcing solutions, technological advancements, and the rising need for regulatory compliance in the insurance sector.

Key Drivers of Market Growth

Growing Demand for Cost-Efficient Solutions

Insurance companies are increasingly outsourcing back-office operations to reduce operational costs and focus on core business functions. BPO services provide cost-effective solutions for claims processing, policy administration, and customer service, driving market growth.

Technological Advancements in BPO Services

The integration of artificial intelligence (AI), robotic process automation (RPA), and cloud-based platforms is transforming the Insurance BPO industry. These innovations enhance efficiency, accuracy, and customer experience, making BPO services more attractive to insurers.

Increasing Regulatory Compliance Requirements

With the insurance industry facing complex and evolving regulatory frameworks, BPO providers offer specialized services to help insurers comply with legal and compliance requirements. This demand is expected to continue growing, further driving market expansion.

Rise in Digital Transformation and Customer Expectations

Insurance companies are leveraging BPO services to improve digital interactions, enhance customer experience, and streamline claims and underwriting processes. The growing adoption of digital platforms fuels the need for outsourcing solutions.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24181

Key Companies in the Insurance BPO Services Market Include

• Concentrix

• Infosys

• EXLService

• Wipro

• Tech Mahindra

• TCS

• Tata Consultancy Services

• WNS Global Services

• Cognizant Technology Solutions

• Infosys BPM

• HCL Technologies

• Accenture

• Sutherland Global Services

• Genpact

• Cognizant

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/insurance-bpo-services-industry-market-24181

Market Segmentation

To provide a comprehensive analysis, the Insurance BPO Services Industry market is segmented based on service type, deployment model, end-user, and region.

1. By Service Type

o Claims Management Services: Outsourcing claims processing for faster settlements and improved efficiency.

o Policy Administration Services: Includes underwriting, policy issuance, and renewals.

o Customer Support Services: Call center and digital support for policyholders.

o Finance & Accounting Services: Management of accounts, billing, and financial reporting.

o Regulatory Compliance Services: Ensuring adherence to evolving insurance laws and regulations.

2. By Deployment Model

o On-Premises: Traditional model where services are managed in-house by BPO providers.

o Cloud-Based: Scalable and flexible solutions leveraging cloud technology for enhanced efficiency.

3. By End-User

o Life Insurance Companies: Managing policy administration, underwriting, and claims processing.

o Health Insurance Companies: Supporting medical claims and policy management.

o Property & Casualty Insurance Companies: Focused on risk assessment, claims, and customer support.

4. By Region

o North America: Leading market due to high insurance penetration and strong demand for outsourcing.

o Europe: Growth driven by strict regulatory frameworks and increasing adoption of digital BPO solutions.

o Asia-Pacific: Fastest-growing region due to cost-effective labor and increasing insurance adoption.

o Rest of the World (RoW): Emerging opportunities in Latin America, the Middle East, and Africa with expanding insurance markets.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24181

The global Insurance BPO Services Industry market is set for sustained growth, driven by cost-efficiency needs, technological innovations, and regulatory requirements. As insurers continue to optimize operations through outsourcing, the demand for specialized BPO services is expected to rise significantly. With evolving digital transformation trends and increasing customer expectations, the market is poised for long-term expansion.

Related Report:

Hybrid Cloud in BFSI Market

https://www.marketresearchfuture.com/reports/hybrid-cloud-in-bfsi-market-32980

Identity Theft Insurance Market

https://www.marketresearchfuture.com/reports/identity-theft-insurance-market-33025

Intelligent Virtual Assistant-Based Banking Market

https://www.marketresearchfuture.com/reports/intelligent-virtual-assistant-based-banking-market-33041

Internet of Things in Banking Market

https://www.marketresearchfuture.com/reports/internet-of-things-in-banking-market-33066

Invoice Factoring Market

https://www.marketresearchfuture.com/reports/invoice-factoring-market-33137

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release