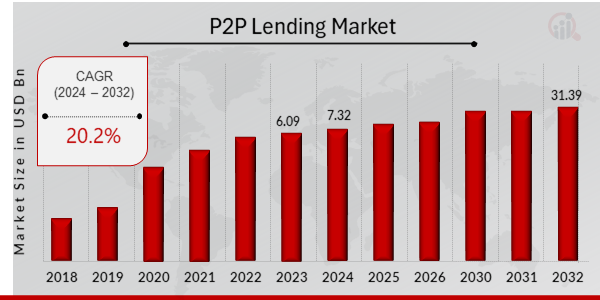

P2P Lending Market to Expand from 31.39 Billion by 2032 | CAGR of 20.2%

P2P Lending Market Growth

P2P Lending Market Research Report By, Loan Purpose ,Loan Amount ,Loan Term ,Interest Rate ,Repayment Method ,Regional

OK, UNITED STATES, April 14, 2025 /EINPresswire.com/ -- The Global P2P Lending market has experienced substantial development in recent years and is expected to witness accelerated growth in the coming decade. In 2023, the market size was valued at USD 6.09 billion and is projected to grow from USD 7.32 billion in 2024 to an impressive USD 31.39 billion by 2032, registering a compound annual growth rate (CAGR) of 20.2% during the forecast period (2024–2032). The surge in digital finance platforms, growing demand for alternative lending, and advancements in financial technology are key drivers fueling market expansion.

Key Drivers of Market Growth

Increasing Demand for Alternative Financing Solutions

Peer-to-peer lending platforms provide borrowers with a streamlined alternative to traditional banking systems. With quicker approval processes and less stringent credit requirements, P2P lending appeals especially to underserved individuals and small businesses.

Rising Internet and Smartphone Penetration

The proliferation of internet access and mobile device usage globally has created a favorable environment for digital lending platforms. This widespread digital connectivity enables easy access to P2P platforms for both lenders and borrowers.

Advancements in Fintech and AI Integration

The use of artificial intelligence and machine learning algorithms has enhanced credit scoring, risk assessment, and fraud detection in P2P lending. These technologies improve the efficiency and reliability of the lending process, thereby attracting more users.

Attractive Returns for Investors

P2P lending offers retail investors an opportunity to earn higher returns compared to traditional savings and investment vehicles. The transparency and control over investment allocation also add to the platform's attractiveness.

Expanding SME Sector and Entrepreneurial Activity

Small and medium enterprises (SMEs), often overlooked by banks, are increasingly turning to P2P platforms for financing. The ease of access and tailored loan products help them secure capital for expansion and operations.

Regulatory Support and Market Formalization

Governments and regulatory authorities in various countries are introducing frameworks to legitimize and regulate P2P lending platforms. This creates a secure environment for market growth and enhances investor confidence.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/26197

Key Companies in the Global P2P Lending Market Include

• SoFi

• Prosper

• Square

• Mintos

• Zopa

• OnDeck

• Funding Circle

• BlueVine

• Kabbage

• Bondora

• Upstart

• Kiva

• Avant

• LendingClub

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/p2p-lending-market-26197

Market Segmentation

To offer an in-depth perspective, the Global P2P Lending market is segmented based on business model, loan type, end-user, and region.

1. By Business Model

• Traditional P2P Lending: Direct loans from individual investors to borrowers.

• Marketplace Lending: Platforms facilitating loans through a variety of institutional and retail lenders.

2. By Loan Type

• Personal Loans: Used for personal expenses, medical bills, travel, etc.

• Business Loans: Targeting SMEs and startups for capital, equipment, or expansion.

• Student Loans: Financing education with competitive interest rates.

• Real Estate Loans: Property-backed lending for purchase or investment.

3. By End-User

• Individuals: Borrowers seeking personal credit for various needs.

• Small and Medium Enterprises (SMEs): Businesses using P2P platforms for accessible and flexible funding.

• Investors: Retail or institutional participants seeking higher yields from lending portfolios.

4. By Region

• North America: Mature market with high fintech adoption and favorable regulatory frameworks.

• Europe: Strong growth due to financial innovation and SME financing needs.

• Asia Pacific: Rapidly expanding market driven by digital inclusion and large unbanked populations.

• Latin America: Emerging market with growing P2P platform penetration and demand for credit alternatives.

• Middle East and Africa: Gradual market development with increased focus on fintech-driven lending solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=26197

The Global P2P Lending market is poised for robust growth, driven by technological advancements, evolving borrower behavior, and the global push toward financial inclusion. As platforms continue to innovate and regulations strengthen, peer-to-peer lending will become an increasingly vital component of the global financial ecosystem.

Related Report:

certificate of deposit market

challenger bank market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release