Bell County Homeowners Benefit From Modest Rise In Property Values Following 2024 Reassessment

O'Connor has confirmed that homeowners in Bell County are enjoying a slight boost in property values following the 2024 reassessment.

BELTON, TEXAS, UNITED STATES, June 28, 2024 /EINPresswire.com/ -- High-end homes in Bell County saw an impressive increase of nearly 28%.

The property tax estimates in Bell County saw a surge from $33 billion to $34 billion, representing a remarkable increase of over 4.2% compared to 2023, amounting to more than $1.3 billion. Notably, homes valued above $1.5 million experienced a substantial market value rise of over $227 million, approximately 28%. These patterns indicate significant price hikes for higher-end homes in 2024. Conversely, properties valued between $250,000 to $500,000 experienced the least growth, with a 1.9% increase. The 2024 review revealed that lower-valued homes experienced a modest rise in their market worth.

In 2024, Bell County’s real estate market saw growth across different property sizes. Bigger properties, especially, stood out with their value going up a lot. Homes over 8,000 square feet increased the most, from $131 million to $165 million, a big jump of 25.6%. Meanwhile, homes between 2,000 and 3,999 square feet saw the least growth, only going up by 3.3%.

Bell County’s Property Values on the Rise

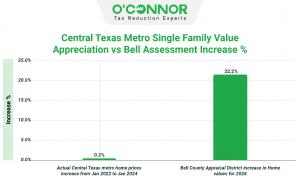

In the aftermath of Bell County’s 2024 property tax reassessment, reports from the Tax Appraisal District reveal a significant surge of 22% in home values. However, a different picture emerges in the Central Texas Metro area, where data from the San Antonio Metro Source indicates a minimal 0.2% increase in property values from January 2023 to January 2024, drawing from previous sales records.

Bell County Properties Experience Varied Increases

In 2024, an in-depth examination of residential property values in Bell County uncovered notable changes. One striking discovery was a substantial 19.4% uptick in the value of residential homes categorized as “others.” Surprisingly, the tax records for this group lack details about their construction years. In contrast, properties built from 1981 to 2000 experienced the smallest increase in value, at a mere 2.4%. Overall, property values have been steadily increasing at an average annual rate of 4.2% across all construction years.

The Tax Appraisal District of Bell County took a close look at 3,567 residential accounts in 2024, which represented 58% of the total. They found that most of these assessments were accurate or slightly overestimated, while 2,611 accounts, making up 42% of the total, were deemed overvalued. This study aims to explore the accuracy of property assessments by comparing the 2023 sales prices to the 2024 property tax reassessment values of residential properties.

Summary of the 2024 Property Tax Reassessment Conducted by the Tax Appraisal District of Bell County

Residential property values in Bell County are on the rise during this reassessment, surpassing the growth rates seen in the Central Texas Metro area. While residential real estate has been profitable overall, the industry has encountered a variety of conditions, with some areas experiencing growth while others see declines. A significant number of homeowners have observed a decrease in the value of their residential properties recently, partly due to the rise in interest rates from 1.71% in January 2022 to 4.05% in January 2024. Consistent revenue patterns and ongoing increases in casualty insurance and other operational expenses also contribute to this situation.

Challenge The Assessed Value of Your Property Annually.

Property owners in Texas, especially those in Bell County, have the right and are encouraged to challenge the assessed value of their property. Whether residential or commercial, owners can provide information during the appeal process to dispute an assessment they believe is too high. It’s highly recommended that owners consider filing an appeal or seeking help from a property tax consulting service, as many protests result in favorable outcomes. With over fifty years of experience, O’Connor excels in advocating for property owners’ rights. Moreover, O’Connor is committed to efficiently reducing taxes for property owners at a reasonable cost, leveraging their ample resources for this purpose.

About O'Connor

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.