Retirement and Reverse Mortgages: What Data Tells Us in 2024

Reverse mortgages provide retirees with cash from home equity, easing financial stress and boosting stability.

LADERA RANCH, CALIFORNIA, USA, August 15, 2024 /EINPresswire.com/ -- As more Americans approach retirement, the need for financial stability becomes paramount. One of the options gaining popularity among retirees is the reverse mortgage, a tool that allows homeowners aged 62 and older to convert part of their home equity into cash. We at Equity Access Group crunched some numbers to find out how hard life after retirement can be and if reverse mortgage can make it easier for people to enjoy their retirement to its fullest.

Understanding Reverse Mortgages:

A reverse mortgage is a financial product that enables seniors to tap into their home equity without selling their home or taking on additional monthly bills. Unlike traditional mortgages, where the homeowner makes payments to the lender, with a reverse mortgage, the lender makes payments to the homeowner. The funds received can be used for various purposes, including covering living expenses, medical bills, or home renovations.

"Reverse mortgages can greatly simplify retirement by offering access to home equity without the need for monthly payments. This flexibility helps retirees manage their finances more easily and improve their quality of life," says Jason Nichols, CMO and partner at Equity Access Group.

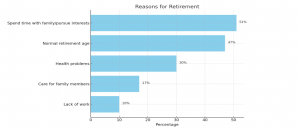

Reasons for Retirement:

Retirees have different reasons for stepping away from the workforce, according to recent data:

- 51% wish to spend time with family or pursue other interests.

- 47% retire upon reaching the normal retirement age.

- 30% retire due to health problems.

- 17% retire to care for family members.

- 10% are forced into retirement due to a lack of work.

What Data tells us about Financial Challenges in Retirement:

• The average retiree has $170,726 in savings, down from $191,659 in 2022.

• 22% of Gen Xers have nothing for retirement, and 43% regret not saving more money.

• 71% of retirees have non-mortgage debt, with an average balance of $19,888. Nearly one in five retirees (18%) have medical debt, with an average balance of $10,259.

• 30% of retirees rely on Social Security as their sole source of income.

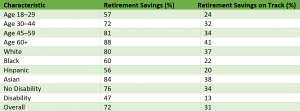

Retirement Savings Across Demographics:

The given table provides insight into retirement savings across various age groups, races/ethnicities, and disability statuses as per the Federal Reserve.

Simplifying Retirement with Reverse Mortgages:

A reverse mortgage can be a game-changer for those with limited retirement savings. It provides a steady stream of income without the need to sell the family home or significantly alter one’s lifestyle. Given the variety of reasons people retire, having an additional financial resource can make a significant difference in the quality of life during retirement.

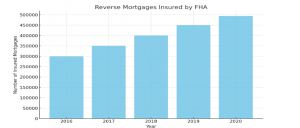

Reverse Mortgage Statistics:

• In 2021, 49,207 borrowers entered into reverse mortgages, up from the previous years.

• As of January 2023, seniors hold an estimated $11.8 trillion in home equity, significantly influencing the reverse mortgage market.

• The NRMLA Reverse Mortgage Market Index (RMMI) rose to an all-time high of 413.22 reflecting an increase in senior home equity, which stands at $11.8 trillion.

Proposed Reforms for Safer Reverse Mortgages:

To make reverse mortgages safer and more appealing, various reforms have been proposed to make this emerging field of mortgages safer-

• Truth in Advertising: Federal regulators should ensure that disclosures, sales practices, and advertising of reverse mortgage loans are not misleading.

• Scams and Fraud: HUD should take enforcement action against reverse mortgage fraud and scams.

• Public Benefits Eligibility: Proceeds from reverse mortgages should not affect homeowners’ eligibility for public benefits programs.

Conclusion:

As revealed by the data we’ve found, retirees face many financial hurdles and reverse mortgages stand out as a crucial resource for improving retirement stability. By tapping into home equity without additional monthly expenses, this option can ease financial stress and improve the quality of life for seniors.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Equity Access Group

+1 888-391-4324

info@equityaccessgroup.com

Visit us on social media:

Facebook

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.