AML Watcher Launches a New Tool to Help EU and U.S. Banks Manage U.S. Secondary Sanctions Risk

The diverse scope of sanctions complicates sanctions compliance. Clearly labeling primary and secondary sanctions make it easy to evaluate risks that may follow

USA, DE, UNITED STATES, November 4, 2024 /EINPresswire.com/ -- AML Watcher Launches a New Tool to Help EU and U.S. Banks Manage U.S. Secondary Sanctions Risk

The world is under the radar for diverse sanctions regimes, divided between primary sanctions and secondary sanctions in terms of scope, often mistaken as having the same intensity making it challenging for financial institutions to expand globally while navigating sanctions compliance risk.

AML Watcher, the leading AML screening solution based on proprietary data, has launched an exclusive secondary sanctions screening feature facilitating foreign financial institutions to comply with global sanctions in a seamless manner.

Think of primary sanctions like a parent grounding their kid—direct, strict, and impossible to ignore and, usually they have implications at home. You're banned, end of story.

Secondary sanctions are like that sneaky friend who pressures everyone else not to invite you to the party because you're on the naughty list—they hit you, even if you’re not directly involved!

Countries often have diverse sanctions compliance regimes and scopes. In the context of the United States, while primary sanctions violation may have monetary penalty, the violation of the US secondary sanctions by foreign financial institutions can lead to loss of access to the US financial systems and markets.

Compliance with US Secondary sanctions is challenging for International Financial Institution for their potential conflict with laws of other jurisdictions. For instance, Financial institutions in European Union may often have to choose between complying with US Secondary Sanctions and EU Blocking Statutes as later sees US secondary sanctions in conflict with EU's laws.

Who might be your lucky charm to let you know the precise seriousness of the sanctions imposed? AML Watcher fills this space by clearly setting out labeled differentiation between primary and secondary sanctions.

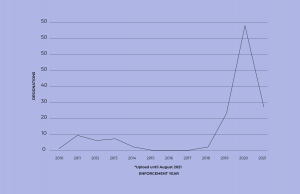

The need for this clarity has increased manifolds. Lately, The U.S. government has added secondary sanctions risk to more SDN lists, particularly those related to sectors associated with Russian military-industrial interests.

Most of these secondary sanctions have been issued under Executive Order 14024, which authorizes the Secretary of the Treasury, in consultation with the Secretary of State and Commerce, to impose penalties on any foreign financial institution found to be conducting or facilitating significant transactions with designated sectors or entities. Enforcement actions may lead to restrictions on U.S. market access and potential designation on the U.S. sanctions list.

One of the earliest and most significant applications of secondary sanctions came with the Iran Sanctions Act (ISA) of 1996. Many financial institutions have opted to mitigate the risks associated with U.S. secondary sanctions through de-risking.

Distinguishing between primary and secondary sanctions is essential for compliance teams since primary sanctions risk may not have any penalty for foreign financial institutions, unless a US nexus is involved but staying oblivion to secondary sanctions risk could lead to loss of access to the US financial system and markets.

A sanctions screening tool clearly labeling, primary sanction risk and secondary sanctions risk associated with a designated entity facilitates sanctions compliance officers by giving them complete information, and thus helping with making more informed decisions and expanding their business with greater confidence.

AML Watcher's exclusive secondary sanctions screening tool clearly adds a secondary sanctions risk label to the name of the designated entity, making it easy to evaluate the level of associated risk and extent of repercussions which may follow.

The volatile geo-political situation in wake of Russia-Ukraine conflict, hints that secondary sanction could be used more frequently as a foreign policy tool by the United States. Therefore, entities with key business stakes in the United States, may need advanced AML screening tools depicting the extent of sanctions compliance risk, allowing for more precise and informed risk management through secondary sanctions screening.

About AML Watcher

AML Watcher is a global leader in anti-money laundering and sanctions compliance technology. With a suite of powerful solutions for sanctions screening, and transaction monitoring, in line with global and jurisdiction specific regulations. AML Watcher serves financial institutions across Europe, North America, and beyond. The company’s innovative technologies empower businesses to meet compliance requirements, manage risks, and maintain the integrity of their financial networks.

Karim Muhammad

AML Watcher

+92 300 9456459

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Insurance Industry, Military Industry, Shipping, Storage & Logistics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release