Houston's Baker Energy Consultancy Publishes Essential Chronology of Mexico's Energy Sector

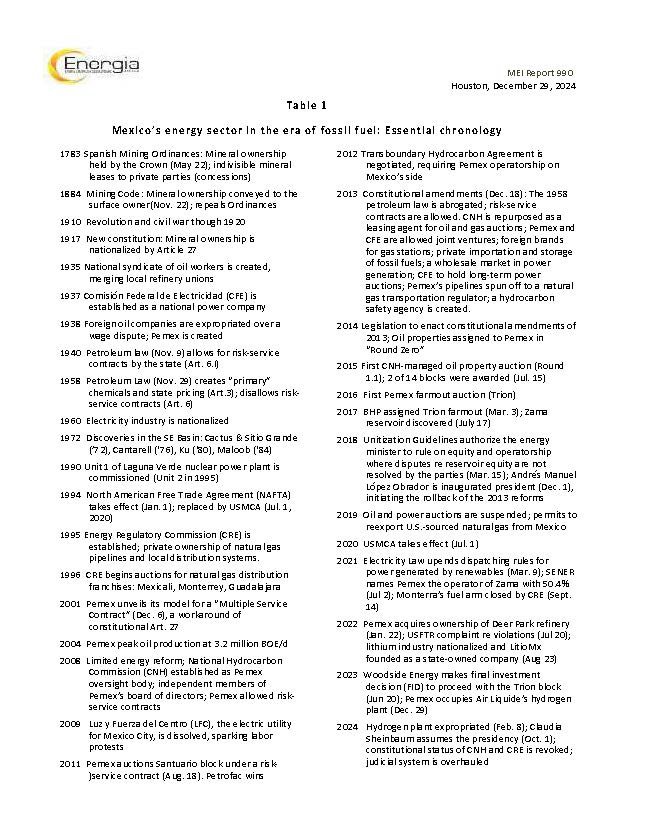

Table 1 - A list of key inflection points in the oil and electricity markets

Since 2018, foreign investors in Mexico's electricity and oil markets have been blindsided by laws, regulatory rulings, and actions by the government

HOUSTON, TX, UNITED STATES, December 31, 2024 /EINPresswire.com/ -- In contrast to the short-term need for market understanding by commodity traders, who are focused on transactional details, investors in Mexico's energy sector require a long-term understanding of inflection- and pressure-points, ignorance of which exposes them to the risk of being blindsided by actions of the legacy oil and power utilities, regulators, and even the president of Mexico.

Since 2018, with the presidency of Andrés Manuel López Obrador, foreign investors in the electricity and oil markets have been thus blindsided, among them investors in renewable power generation, and, in oil markets, Talos Energy, Monterra Energy and Air Liquide, among others.

Table 1 of this report provides a basic chronology of infliction points in the electricity and oil markets in Mexico. The starting date is 1783, which marks the final revision of the Spanish mining code. The report calls attention to the mineral lease that the Crown offered to miners: The miner risks his capital in exchange for the right to continuously produce and profit from his mine, paying a royalty established by regulation (commonly 1/5th). This model in its philosophy and essential features is found today in the licenses issued by the U.S. Bureau of Energy Management (BOEM) in federal waters in the Gulf of Mexico and elsewhere.

When, in 1917, a new constitution restored public ownership of the mineral estate, the Spanish regime of concessions was not adopted. Instead, in 1940, after the oil expropriation of 1938, the government offered "risk-service contracts" to oil companies. By this contract, the state (aka, the nation) would remain owner of production and reserves, and the lease (or license) holder would not (as with the Spanish regime) have the right to sublease portions of his property.

"For the oil and gas investor, what is missing is a modern mineral lease, insists George Baker, principal author of the report, “one which retains public ownership but conveys full commercial rights and with the area divisible by farmouts."

"A chronology," he cautions, "only provides dots which the investor must connect to be able to weigh the likelihood of state disruptions of his business model and expectations. A chronology helps in providing successive screen shots of how the government and its legacy energy companies have acted in the past."

Appended to the report is an annotated title list of ten prior reports that examine economic and contractual features of a farmout.

George Baker

Baker & Associates, Energy Consultants

+1 832-434-3928

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Automotive Industry, Banking, Finance & Investment Industry, Companies, Energy Industry, Law

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release