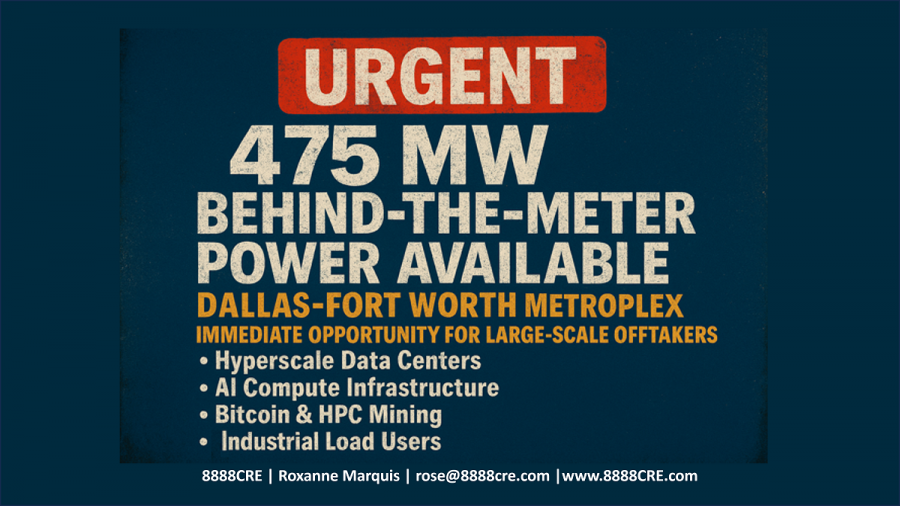

475 MW Behind‑the‑Meter Power Site in DFW Seeks Offtaker Amid Soaring Data Center Energy Needs

Texas’s newest 475 MW behind-the-meter (BTM) power site emerges alongside critical industry developments, reshaping how data centers secure dedicated capacity.

DALLAS, TX, UNITED STATES, July 21, 2025 /EINPresswire.com/ -- As ERCOT’s interconnection queue now stretches past 2028, site selectors are racing for private power solutions. Today, an 475 MW behind the meter site in DFW hits the market—one of only two of its scale in Texas. In a market starved for reliable capacity, this PPA ready, on site 475 MW asset offers a bridge to permanent power solution—available now. A strategically located 475 megawatt (MW) behind the meter (BTM) power site is now exclusively available in the Dallas–Fort Worth Metroplex, ready for offtake and deployment within nine months. The site offers bridge to permanent power—BTM generation to support near term operations while permanent infrastructure is constructed and interconnection to the grid is negotiated—leveraging the energy companies 20+ years of mission critical power development expertise, and benefitting from on site natural gas supply for cost effective, reliable fuel. Represented by Roxanne Marquis of 8888CRE, this PPA ready opportunity is tailored for hyperscale data centers, colocation providers, cloud computing, edge integrators, and AI infrastructure operators. This is one of two sites in Texas with 475 MW of power ready for a company to secure their Power Purchase Agreement (PPA) today.

"With an immediate 475 MW capacity primed for power purchase agreement (PPA) structuring, this expertly engineered site delivers exceptional operational control, robust resilience, and optimal energy efficiency, perfectly suited for handling intensive AI workloads and high-performance computing demands," emphasized Roxanne Marquis, Principal Broker at 8888CRE.

REGULATORY LANDSCAPE HIGHLIGHTS PRIVATE POWER ADVANTAGE

• Texas SB-6 (effective May 27, 2025): Shifts interconnection costs onto large-load consumers, notably data centers, making behind-the-meter solutions economically favorable.

• ERCOT Grid Curtailment Law (June 25, 2025): Allows emergency load shedding for high-demand facilities, emphasizing the strategic benefit of dedicated, dispatchable on-site generation.

RISING DATA CENTER MARKET DRIVES POWER DEMAND

• McKinsey Projection: U.S. data center electricity demand expected to grow from 25 GW in 2024 to 80 GW by 2030, representing a 23% CAGR, intensifying demand for reliable private power solutions.

• ERCOT Interconnection Delays: Interconnection queues extend past 2028, necessitating immediate private generation solutions.

RECENT INDUSTRY TRENDS REINFORCE VALUE PROPOSITION

• Tract’s 2,000 MW Gas-Generation Campus (June 2025): Highlights critical advantages of onsite generation, mirroring the capabilities of this 475 MW site for guaranteed dispatchable energy independence.

• CoreWeave’s $9 Billion Acquisition of Core Scientific: Reflects surging hyperscaler demand for expansive power footprints, precisely what the DFW site delivers.

• Mitsui’s Floating Micro-Data Center Pilot: Validates interim capacity models; this terrestrial, behind-the-meter site simplifies deployment with robust, dedicated power infrastructure, suitable for green, modular, and micro data center construction.

WEEKLY INDUSTRY HIGHLIGHTS: POWER DEMAND & GROWTH (Week of 8 15 July 2025)

• PJM Grid Warns of 32 GW AI Load Surge – Capacity auction prices up 800 % as analysts project electricity bills could rise 20 %.

• Texas ERCOT Sees 70 GW of New Data Center Load – State considers fast track curtailment rules to protect reliability during peaks.

• Google Commits Additional $7 B in Iowa Cloud and AI Capacity – New Cedar Rapids build and Council Bluffs expansion push state total past $25 B.

• Sydney’s Macquarie Tech Secures AU$240 M Parcel for 150 MW Hyperscale Hub – Campus targets AI, cloud, and secure government workloads.

• Yondr Energizes Second 20 MW Phase in Frankfurt, Surpassing 100 MW Online in 12 Months – Europe’s tightest power market remains supply constrained.

• Dell’Oro Group: Data Center Capex to Exceed $1 Trillion by 2030 – Rack densities climbing toward 600 kW, liquid cooling deployments double year on year.

• New Study Questions U.S. AI Chip Availability – London Economics warns demand forecasts could absorb 90 % of global GPU output, signaling potential bottlenecks.

GLOBAL MOMENTUM AND STRATEGIC ALLIANCES

Global developers are rapidly forming strategic partnerships and alliances, driven by unprecedented demand for AI, hyperscale computing, and sustainable data center solutions. Recent highlights include:

• AWS and Mitsubishi Partner in Japan: Expanding hyperscale and AI-ready data centers to meet escalating regional demand.

• Microsoft and ADNOC Collaborate in UAE: Developing carbon-neutral, AI-enabled hyperscale campuses to accelerate digital transformation across the Middle East.

• Equinix and GIC Accelerate Green Data Centers in Europe: Joint ventures targeting low-latency, sustainable modular deployments across Frankfurt, Amsterdam, and London.

• Google and Iberdrola Strengthen Alliance in Spain: Expanding renewable-powered hyperscale and modular facilities to support cloud and AI infrastructure growth.

• CoreWeave and NVIDIA Intensify Collaboration in the U.S.: Committing to large-scale GPU deployments to alleviate the AI chip bottleneck, reinforcing the need for dedicated, scalable power.

LATEST GLOBAL DEVELOPER ACTIVITY SNAPSHOT

Recent announcements and land activity across key international and U.S. markets signal strong demand in the hyperscale, cloud, edge, and AI data center sectors:

• Bahrain: Strategic investments in hyperscale and cloud campuses to serve the Gulf Cooperation Council (GCC).

• Brazil: Several new data center and edge computing campus developments, particularly in São Paulo and Rio de Janeiro.

• Canada: Montreal and Toronto remain hotbeds for AI infrastructure builds, supported by local incentives.

• France: Paris region sees rising green data center investments utilizing modular and liquid-cooled deployment strategies.

• Germany: Frankfurt‐region footprint grows with ultra-high-density AI compute campuses.

• Japan: Tokyo and Osaka are expanding edge-micro DC sites to meet AI and 5G compute demand.

• South Korea: Seoul continues to scale large site deployments powered by renewable and behind the meter generation.

• Netherlands: Amsterdam’s hyperscale campus network expands modular AI infrastructure.

• Qatar: Construction underway on AI-ready campuses aligned with national 2030 Vision.

• Saudi Arabia: New cloud and AI data center builds in Riyadh and Neom, focusing on high density workloads.

• Singapore: Modular and micro DC growth driven by Southeast Asia’s AI and edge requirements.

• Spain: Madrid and Barcelona see multi MW expansions targeting compute intensive use cases.

• Switzerland: Basel and Zurich benefit from energy efficient AI clusters and green micro DC rollouts.

• United Arab Emirates: Dubai and Abu Dhabi invest heavily in hyperscale and edge-ready AI campuses.

• United Kingdom: London region builds focusing on AI compute and green energy integration.

• United States: Major growth in AI and high-performance computing campuses across coastal and Central U.S. markets.

• Texas: DFW and Austin maintain leadership in large scale hyperscale, modular, and green data center deployment—making this 475 MW DFW site especially strategic.

ADDITIONAL COUNTRIES ENGAGED IN U.S. DATA CENTER DEVELOPMENT

• Singapore – Through GIC’s joint venture with Equinix to add over 1.5 GW of hyperscale capacity in the U.S. The Sun+15Reuters+15San Antonio Express-News+15

• Canada – Canada Pension Plan Investment Board (CPP Investments) partnered with Equinix in that same JV Reuters

• Israel – Compass Datacenters, now owned by a U.S.-Canada-UK private equity consortium, is active in the U.S. and, per its history, also investing internationally (including Israel) Wikipedia

• Mexico – Infrastructure provider HostDime operates data centers in the U.S. and Mexico

WHAT'S BUZZING IN ENERGY AI DATA CENTER NEWS

• U.S. Energy & Innovation Summit (July 15, 2025): Big headlines came from the summit at Carnegie Mellon where former President Trump, along with leaders from Meta, Microsoft, Alphabet, ExxonMobil, and FirstEnergy, unveiled a coordinated push to position the U.S. as the global AI energy leader—revealing $70 billion in combined AI and energy investments to support AI infrastructure and data centers

• CoreWeave invests $6 B in Pennsylvania: Linked to the federal push, CoreWeave’s newly announced mega site (initially 100 MW, scaling to 300 MW) demonstrates the surge in private AI data center development tied to energy strategy

• Meta’s Gigawatt scale Tent Data Centers: To tackle build speed and power demands (up to 5 GW facilities like “Prometheus” and “Hyperion”), Meta is deploying temporary tent setups—highlighting the extreme energy requirements of next gen AI hardware

• Google’s $3 B Hydro PPA: Google inked a major deal for 670 MW of hydropower, with options for up to 3 GW in future—aligning green energy with AI heavy cloud and data center power demands

• Innovation in grid balancing: Nvidia-backed Emerald AI piloted software that dynamically adjusts AI workloads based on grid stress—all while cutting peak energy consumption by 25% in field trials

IDEAL APPLICATIONS FOR THE TEXAS SITE

• Hyperscale AI computing clusters

• Colocation and cloud service providers

• Edge computing and micro data center deployments

• Industrial, R&D, and sustainability-focused green data centers

KEY BENEFITS

• Energy Independence: Robust resilience, predictable costs, and immunity from ERCOT interconnection delays.

• Immediate Dispatch Capability: On-site generation provides uninterrupted, scalable energy capacity.

• Strategic DFW Location: Proximity to extensive fiber networks, skilled workforce, and efficient logistics supporting rapid site migration and expansion.

FEATURED TEXAS LAND PORTFOLIO: PREMIER SITES FOR HYPERSCALE, AI & CRYPTO DATA CENTERS (8888CRE)

From an 82-acre West Texas parcel ready for a speculative buyer to a substantial 5,000-acre Panhandle tract with a possiblity of 4 GW through SMR, BTM, and future grid connection with robust 345 kV transmission access, 8888CRE’s current listings cater to the full spectrum of digital infrastructure requirements. In the thriving Dallas–Fort Worth metroplex, we offer a strategic 1,500-acre property positioned for phased hyperscale campus growth or colocation expansion, currently seeking joint venture partners or developer acquisition. Additionally, a site in Sulpher Springs Texas has 475 MW ready for immediate use and is seeking an end user immediately. Roxanne Marquis and 8888CRE deliver turnkey power solutions, scalable sites, and strategic partnerships, streamlining utility interconnections and expediting your data center projects.

8888CRE POSITIONS TEXAS DATA CENTER LAND FOR GLOBAL AI INFRASTRUCTURE DEVELOPERS

8888CRE is the premier brokerage dedicated exclusively to data center land across Texas, strategically aligning power-ready acreage with international buyers and investment capital from key technology markets including Bahrain, Brazil, Canada, France, Germany, Japan, South Korea, Netherlands, Qatar, Saudi Arabia, Singapore, Spain, Switzerland, the UAE, the UK, and leading U.S. tech corridors. Under the guidance of seasoned industry expert Roxanne Marquis, 8888CRE combines strong local utility relationships—such as Oncor, AEP, ERCOT, and SPP—with an expansive global network of hyperscale operators, real estate investment trusts (REITs), and infrastructure funds. The firm specializes in accelerating interconnection studies, fiber network integrations, zoning approvals, and customized build-to-suit negotiations. Whether developing a large-scale 500 MW microgrid behind-the-meter solution, integrating advanced battery energy storage systems (BESS), or assembling strategic off-market sites tailored for AI, edge computing, and colocation requirements, 8888CRE ensures faster deployment timelines, reduced project risks, and maximized investment returns for landowners and data-center developers.

SEEKING STRATEGIC CHANNEL PARTNERS FOR TEXAS AI DATA CENTER PROJECT PIPELINE

8888CRE is actively onboarding strategic channel partners capable of delivering power capacity, rapid deployment capital, underwriting studies, interim site acquisitions, and accelerated facility construction. If your organization specializes in compressing project timelines, enhancing power and network performance, or mitigating large-scale AI infrastructure risks, please forward a concise, two-sentence capability summary highlighting your scale and service capabilities directly to Roxanne Marquis or call +1 972-805-7587.

TEXAS LAND BANK INVESTMENT OPPORTUNITIES

8888CRE maintains an active forward pipeline of strategic Texas land tracts ideal for land banking. We invite capital partners interested in stepping in during critical 12 to 18-month interim periods—acquiring properties early, funding essential infrastructure and feasibility studies, and exiting upon achieving key milestones such as interconnection approvals and entitlement processes, thus unlocking substantial end-user take-down value.

DISCOVER THE POTENTIAL OF YOUR TEXAS PROPERTY AS A DATA CENTER POWER SITE

If you own land in Texas with power availabity you are be holding an exceptionally valuable asset in today's rapidly evolving AI and digital infrastructure market. Hyperscale data center developers are actively seeking suitable campus locations, and demand is outstripping supply. At 8888CRE, we expertly position and discreetly market high-potential properties by aligning land assets with critical infrastructure strategies, targeted power provisioning, and global developer requirements. Engage in a confidential discussion with us today to evaluate your property's true potential and market value in the thriving AI infrastructure landscape.

TEXAS: GLOBAL HUB FOR AI AND DATA CENTER INFRASTRUCTURE DEVELOPMENT

Texas has emerged as the definitive global nexus for AI infrastructure, uniquely benefiting from an ideal combination of abundant energy resources, expansive land availability, supportive regulatory policies, and robust investor enthusiasm. With significant data center developments spanning Amarillo, Marfa, Abilene, Lancaster, and beyond, the competition to secure prime sites is intense—and Roxanne Marquis stands at the forefront. Renowned for her extensive expertise in zoning analytics, international partnership structures, and strategic market intelligence, Roxanne has successfully guided private equity and corporate entities toward profitable technology-sector investments. Her latest book, Unlocking Profits in AI Data Center Real Estate, delivers practical insights into optimal site selection, effective utility negotiations, and sustainable development strategies, empowering developers, investors, and landowners to effectively capitalize on this booming, competitive market.

IMMEDIATE ACTION ENCOURAGED

This premier power and land opportunity is expected to move quickly. Interested parties should promptly schedule site visits, request detailed technical documentation, and begin power purchase agreement (PPA) negotiations.

Contact for Information

Roxanne Marquis

Principal Broker, 8888CRE

Email: rose@8888cre.com

Phone: +1-972-805-7587 (International)

Website: 8888CRE.com

ABOUT 8888CRE

8888CRE is a specialized brokerage connecting power-ready data center land with global AI infrastructure developers and investors across North America and international markets including Europe, the Middle East, Asia-Pacific, and Latin America. Led by industry expert Roxanne Marquis, 8888CRE leverages extensive relationships with major utilities and power providers alongside a worldwide network of hyperscale companies, colocation providers, infrastructure funds, and institutional investors. Offering turnkey land and power solutions, 8888CRE streamlines interconnection studies, fiber pathing, zoning approvals, and build-to-suit negotiations, accelerating deployment timelines, reducing project risks, and maximizing long-term asset value for both landowners and data center developers.

Roxanne Marquis

8888CRE.com

+1 972-805-7587

rose@8888cre.com

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Other

475-megawatt (MW) behind-the-meter power is available in the Dallas–Fort Worth Texas, ready for offtake Power Purchase Agreement (PPA) negotiation.

Distribution channels: Agriculture, Farming & Forestry Industry, Amusement, Gaming & Casino, Automotive Industry, Aviation & Aerospace Industry, Banking, Finance & Investment Industry, Book Publishing Industry, Business & Economy, Chemical Industry, Companies, Conferences & Trade Fairs ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release